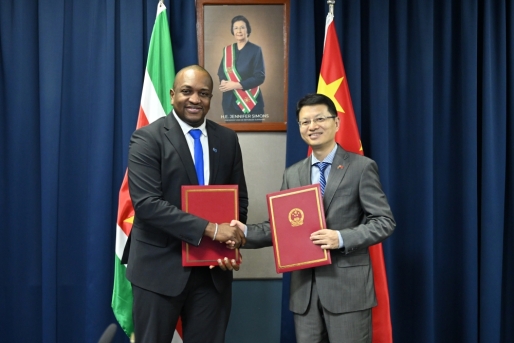

Minister Raghoebarsing spreekt de pers tijdens de IMF/ WB jaarvergadering

| cds | Door: Redactie

After scarcity, Suriname faces the problems of plenty as oil boom begins

By Oliver West

South America’s smallest country, Suriname, is on the verge of an unprecedented era of abundance after TotalEnergies on October 1 confirmed its commitment to an offshore oilfield that will bring an estimated $10.5bn of investment to the country — more than twice its GDP.

The government has already made difficult choices to rehabilitate its economy, but finance minister Stanley Raghoebarsing and foreign affairs minister Albert Ramdin told GlobalMarkets that the country had arguably an even bigger challenge ahead: to make the most of a potentially transformative oil

Suriname has come back from the brink under President Chandrikapersad Santokhi. After an International Monetary Fund-endorsed debt restructuring from 2020 to 2023, Suriname’s debt

“Santokhi has done an incredible job in slashing subsidies and increasing the revenue base, and deserves credit,” said Nathalie Marshik, managing director in EM credit trading at HSBC. “The IMF must be extremely happy with the job the government has done.”

Total’s investment exceeds earlier expectations of $9bn, and Marshik said it was “very, very good” for the country. She said Suriname also needed “laws and structures in place that ensure the oil money is responsibly used”.

CHOICE OF PARTNERS

Raghoebarsing highlighted the importance of protecting central bank independence, making sure Staatsolie, the state oil company, continued to operate in a business-like fashion — not preselling oil — and building institutional strength. Some cash-strapped countries have presold oil at low prices, including to China, while it is still in the ground, but this can tempt them to overspend.

Suriname’s new sovereign wealth fund is already staffed and will be linked to future budgets. Raghoebarsing insisted Suriname’s problems which had “built up over decades” could “not besolved in three years”, and that the stage was set to consider a follow-up IMF programme — though after the next election in May 2025. Newfound oil wealth means, however, that Suriname is likely to have the luxury of choosing its financing partners. Foreign minister Ramdin said they should be chosen “on the basis of good merits and good evaluations”. They may not be the traditional Bretton Woods institutions. “I think it’s time for the government to build relations with other IFIs in other parts of the world that can provide resources as well,” said Ramdin. Suriname was not eligible for the G20 Common Framework on restructuring as it was not an International Development Association member, and Ramdin said the process “suffered” as a result. “The IMF, World Bank and IADB should be willing to consider the new Multidimensional Vulnerability Index in their operational framework, and if they’re not willing to do that, we’ll need to look at other lenders that are,” said Ramdin.

Another challenge of the oil boom is whether Suriname can maintain its status as one of a select few carbon sink countries in the world — meaning it absorbs more carbon from the atmosphere than it releases. “We are committed to remain that even if we are extracting oil,” said Raghoebarsing. “This is an important commitment for us and the global community, but it’s also important for us because we have an opportunity to monetize the carbon.”

Source: Global Markets Special Daily Edition WORLD BANK/IMF Thursday 24 2024

| cds | Door: Redactie