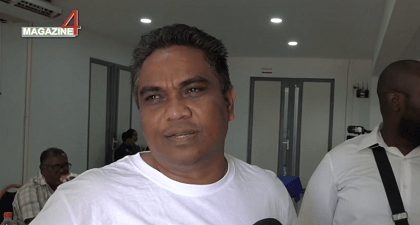

Bloomberg in gesprek met Minister Raghoebarsing’

| cds | Door: Redactie

(Bloomberg) -- Suriname, which is on the verge of becoming a major South American energy producer, is ruling out more borrowing against future oil production, according to its finance minister.

TotalEnergies SE and APA Corp. this month announced a $10.5 billion offshore project that will begin pumping crude as soon as 2028. Minister of Finance and Planning of Suriname Stanley Raghoebarsing said the nation isn’t considering loans that are guaranteed by those revenues, despite hearing offers from brokers in Washington this week.

“In no way do we want to pre-sell oil that we still have to lift, and collateralize that for easy

The comments provide a window into how one of the world’s newest oil patches is approaching its forthcoming bounty, which the state oil company estimates could bring in as much as $26 billion. The prospect of a huge windfall helped it win a double-notch credit upgrade from Moody’s Ratings this week, which lifted the nation to Caa1 — still deep in junk level — with a positive outlook.

The $4.9 billion economy is forecast to grow 3%

A year ago, the government finalized a debt restructuring that included so-called value-recovery instruments that pay investors a portion of revenue from oil after it starts flowing.

The price for those securities has more than double to around 101 cents on the dollar over the past year. Sovereign bonds, meanwhile, that are due in 2033 have returned 13% this year, double that of emerging-market peers, according to data compiled by Bloomberg.

Raghoebarsing said the government isn’t considering selling more of the oil-linked instruments. “Some people are saying that we need additional funds and we we want to sell the VRI,” he said. “We’re not going at all doing down that road.”

Investors have also proposed buying back some of that debt early through mechanisms including debt-for-nature swaps. Raghoebarsing said the government weighed the idea but concluded that they weren’t worth it.

IMF Program

The nation will wait until after May’s nationwide elections to decide on whether to ask for a new program with the International Monetary Fund after the current $688 million deal expires in March, Raghoebarsing said.

In the meantime, the nation this week signed an agreement with the World Bank to be included in the list of International Development Association countries. That will unlock about $22 million of concessional financing that will be used to improve living conditions in the capital, Paramaribo.

He said the country of roughly 650,000 has to carefully balance the newfound wealth that will come with oil discoveries. It has established a sovereign wealth fund for those revenues and is adapting the laws governing it so that funds available to be used in the budget.

The law is being changed, “so that today’s generation does not feel as if you’re putting everything for the future generations and we are suffering,” he said. “You take care of today’s generation and you make sure that you are taking care of the next generations.”

--With assistance from Zijia Song.

©2024 Bloomberg L.P.

https://www.bnnbloomberg.ca/markets/oil/2024/10/25/suriname-rules-out-b…

| cds | Door: Redactie